- Home

- About

- Insurance Services

- Claims

- News

- Community

- Contact Us

- Important Info

- Specialist Industries

You are here

List News Articles

Introducing Steve Thurston

We recently welcomed Steve Thurston to the Capital Mutual team. Steve joins us as Account Executive, and brings over 23 years’ experience in the financial services industry, with almost 10 years served as an insurance broker.

Steve’s extensive experience includes working for one of the big international financial services firms in various sales, broker and leadership roles, and as an Insurance Broker within the Steadfast Group.

5 things you need to know about underinsurance

Insurance claims information following the bushfire devastation has highlighted the widespread problem of underinsurance for homes and businesses.

Figures show the majority of homes and businesses are underinsured, regardless of whether you operate in a regional area or large metro CBD. Underinsurance can greatly increase the risk of a business having to close down if something goes wrong.

Here are 5 of the main things you need to know about underinsurance relating to fire and business interruption for organisations:

Holiday office hours

Our office will be closed from 24 December until 2 January.

If a emergency does arise however, you can call Penny on 0417 372 968 or Seamus on 0421 444 950.

Have a safe and happy holiday.

5 things to keep your business safe over the holiday period

1. Check your security systems if you are closing your business over the holiday season. If the property is going to be empty for a period, it is doubly important to make sure the security is up to scratch and alarms still working. Check all the alarm batteries, locks, windows etc.

Insurance Council explain 'crisis of confidence' in construction sector

This article details more of the reasons behind the challenges of construction professional indemnity insurance and what can be done to rectify the issues. If you’d like to know more or have questions, speak to us now.

Read the full article

Calls on Federal Government to fix building cladding issue

The latest twist in the building cladding debate has seen five organisations seeking the federal government to take leadership role and the Victorian Government propose insurers pay for fixing flammable cladding.

What does this mean for the building industry?

We are monitoring the situation closely, so contact us to discuss your circumstances and we will help you navigate the issue.

Is lack of insurance going to stop your business activity?

You are probably aware of the challenges facing insurance renewals for building certifiers and surveyors.

The recent article in Insurance and Risk Professional talks about the challenges facing the construction industry.

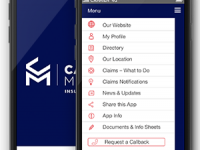

Have you downloaded our Brokerapp?

Download the Capital Mutual Brokerapp for useful information and tools when you need to contact us, lodge a claim or require fast access to your insurance portfolio details.

We will be right there for you, on your phone, 24/7.

Available for free in iTunes and Google Play

5 things to know about Premium Funding

1. Premium Funding improves your cash flow by enabling you to pay your insurance premiums in flexible repayments - allowing working capital to stay in your business working for you.

2. Funding arrangements sit outside of any bank loans - your existing lines of credit are not impacted.

3. There are no on-going service fees and the repayments are fixed - you’ll always know how much to pay

Are you prepared for changes to the Professional Indemnity insurance market?

We have rarely seen the drastic changes some businesses’ Professional Indemnity (PI) insurance are facing. We want to make sure you don’t get any nasty surprises in your upcoming insurance renewal.

PI insurance is under pressure. You need to check for:

• Rising premiums

• Reduced sub-limits

• New exclusions restricting your cover

• Your policy limits in conjunction with contracts - Councils and Government agencies typically request a minimum $10m limit, with many now requiring $20m